Having the right money mindset is crucial for financial well-being.

Your overriding attitude and beliefs about money have a huge impact on the financial decisions you make and the financial success you achieve.

Achieving a healthy money mindset has a powerful impact on your real life. But it can be hard to make the right changes and build good habits. Not to mention, you also have to target and eliminate a negative money mindset – something we all have consciously or unconsciously.

This post will provide tips for developing a positive money mindset to improve your financial life.

As a single mother who was determined to change her life and her son’s, I did a great deal of internal and practical work to find financial stability. Many of these money mindset tips come from my personal experience as well as from powerful books, courses, and experts whose financial tips have made a difference in my life.

Keep reading to learn

- How to reflect on past financial mistakes

- How to set clear goals

- Shift from a scarcity to an abundance mindset

- Replacing negative self-talk and more.

Key Money Mindset Takeaways

- Take full and complete responsibility for your finances. No one, not even your parents, spouse, or government, is responsible for your personal finances.

- Focus on your financial education using courses, books, magazines, newspapers, and other means.

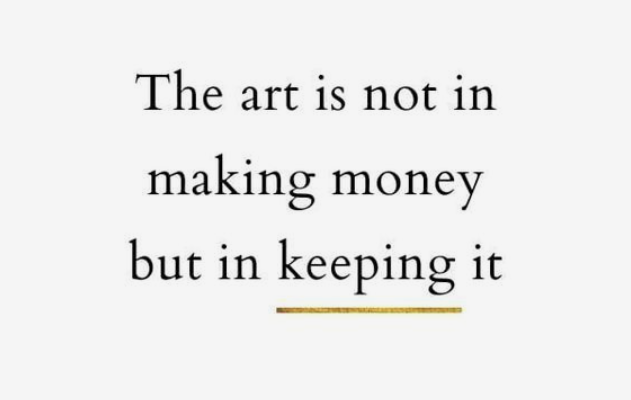

- Save money as much as you can – even if it’s a few paise or cents. It’s about who you become when you save rather than how much you save.

- Be clear about needs and wants and make short-term sacrifices for long-term gains.

- Invest for the long run.

Read on for actionable steps that will positively impact your financial situation now and in the future.

51+ Money Mindset Tips to Change Your Life

Let’s dive in and get the best tips on changing your mindset on money.

Take Responsibility

- The reality is that your financial future is your responsibility alone. No matter how good or bad your environment and situation are, you’re the only one who can process it and make a change.

- Ask yourself if you’re embodying the archetype of a ‘princess’ or ‘victim,’ i.e., someone waiting to be rescued or validated. For me, this meant realizing that I was behaving like a princess in a tower, waiting for someone to let me out. The truth is, this might never happen. It’s up to me to be my own rescuer.

- Taking responsibility could be as simple as tracking your expenses and choosing to address your debt, or it could be as large as starting your own business. The core idea is that you choose to face your finances head-on.

- It also means acknowledging when you have bad money habits and deciding to change them. You could develop financial management skills, join a personal finance community, or do something else that makes you more responsible for money in general.

Making Peace With Past Financial Mistakes

- Recognize that you made mistakes with money in the past and accept it fully. Also, forgive yourself and others for their errors. For me, this meant getting over the fact that I rejected at least two good job opportunities in the past due to being young and dumb. It also meant accepting and getting over the fact that my family members also made bad money decisions in the past like selling property for cheap that might have 6-figure valuations today.

- Reflect on your past money habits and identify any negative patterns. Were there certain triggers that caused you to overspend or make poor financial decisions? Understanding what didn’t work in the past is the first step toward creating positive changes. For me, this meant undoing my parents’ views on spending by eating out a lot as the primary way to enjoy life.

- Make an account of your current financial situation honestly and make peace. You’re done with beating yourself up over past mistakes.

- Analyze what specific factors led you down an unhealthy money path. Common problematic behaviors include impulse purchases, keeping up with trends, buying things to impress others, unhealthy money beliefs you inherited from your family, and so on.

- Start replacing negative money mindsets with more constructive attitudes. If you’ve made the mistake of using your credit card to buy something you didn’t need in the past, build the mindset that you’re enough and whole without material items to make you feel good.

Set Clear Financial Goals

Setting clear financial goals is crucial for developing a positive money mindset. Both short and long-term goals give you something specific to work towards. Here are some specific financial goals to set:

- Create Short-term savings goals: Set a goal to save a certain amount each month or year for emergencies, vacations, or big purchases. Even small amounts add up over time.

- Long-term savings goals: Saving for major life events like a house, retirement, or your child’s college fund. Break the big goals into smaller milestones.

- Determine your ideal salary, and don’t be afraid of the number. You’ll open your mind to the ‘how’ of achieving this once you fully acknowledge that you have a specific amount you want to get.

- Debt repayment goals: If you have debt like student loans or credit cards, make a plan to pay it down aggressively. List each debt by amount and interest rate. Tackle the high-interest debt first while making minimum payments on the rest.

Having tangible financial goals creates accountability, gives you motivation through each milestone, and helps you prioritize where your money should go each month. Stay focused on the next goal on your list as you build positive money habits.

Replace Negative Self-Talk

Negative self-talk can sabotage your money mindset. This set of tips will address identifying negative self-talk and how to address them.

- Pay attention to your inner dialogue and monitor any limiting beliefs or “I can’t” statements that arise.

- Stop negative thoughts as they occur and consciously shift to a more positive mindset. If you catch yourself thinking defeatist statements like “I’ll never get out of debt” or “I don’t deserve financial success”, pivot your internal monologue.

- Ask yourself if you’re being ‘realistic’ by being negative or if you’re indulging in negativity bias. We’re all too familiar with positivity bias but negativity bias is real too – this is when you focus on bad things even when the situation is generally good.

- Practice using positive affirmations related to money instead. Even if you don’t fully believe them yet, repeating empowering phrases can rewire your brain over time.

- If affirmations and mantras prove too hard or appear foolish, then switch to asking questions instead. For example, is it true that you’re trapped? What are the different ways you can afford your car payment? And so on.

With consistent effort, you can move from scarcity and fear around money to embracing positive money mindsets rooted in possibility and abundance. Monitor your self-talk; limiting beliefs will shift.

Cultivate an Abundance Mindset

Overriding the scarcity mindset with an abundance mindset can have a huge impact on your finances. Scarcity thinking leads to fear, anxiety, and unhealthy financial habits. Abundance thinking opens you up to seeing financial opportunities and believing in your ability to create wealth and prosperity.

Some tips for cultivating an abundance mindset:

- Focus on the opportunities around you rather than what you lack. Train yourself to notice chances to increase your income.

- Avoid scarcity thinking and messages that reinforce lack. Limit media or conversations suggesting money is scarce.

- Affirm abundance. Use positive affirmations and self-talk focused on prosperity. Believe in your power to achieve financial goals.

- Visualize success. Regularly imagine your financial goals as already completed. Feel abundant in mind and spirit.

- Be grateful. Appreciate what you have right now. A grateful mindset attracts more good into your life and it motivates you to do good for others. According to one study, gratitude increases the sense of inner wealth which drives you to help others and donate to charitable causes.

- Ask yourself if you believe that the world offers you limited sources of money or if you have to earn more or save more, you’d deprive others. There’s no real reason to believe that there isn’t enough for everyone in the world as long as we don’t indulge in extreme greed. Not everyone wants a billion dollars and you should have the mindset that you can make more money and feel good about it.

Adopting an abundance mindset takes practice, but is worth the effort. It empowers you to make better financial decisions and change your money situation for the better.

Money and Values

- Money is a tool that can be used for good or bad. It doesn’t inherently have any meaning. Focus on how you can use money consciously to improve your life and the lives of others.

- Money doesn’t define your self-worth or value as a human being. Many worthy and valuable human qualities have nothing to do with money, like kindness, empathy, creativity, and generosity. Don’t let your net worth become your self-worth.

Save First, Spend Later

One of the best ways to build wealth over time is to make saving money an automatic habit. Let’s look at simple tips you can use:

- Pay yourself first. When you get your paycheck or other income, the first “bill” you pay is to your own savings account.

- Even if you can only save a small percentage of your income, pay yourself first before paying any other bills. Generally, it’s advised to save 10% of your income but that isn’t possible for most people. If you can save just 1% that still makes a difference.

- Automate your savings. This is an easy way to make sure you consistently save. Set up automatic transfers from your checking account to your savings account each month. Online banks make this very simple to set up. The money will be moved before you even have a chance to spend it on something else.

- Make savings non-negotiable.

As you save money, you won’t feel anxious, and seeing your savings grow will change your mindset for the better.

Limit Use of Credit Cards

Relying too heavily on credit cards can lead to debt and financial distress. Here are a few tips to limit credit card use with the right mindset:

- Understand that using credit cards can be dangerous when you’re financially unstable. The interest is more than you realize and easily increases your final spend.

- Don’t view using credit cards as an escape mechanism. See it as an important and difficult commitment you engaging in.

- Prioritize and value spending money you actually have. Do this by using cash or debit cards whenever possible. Paying with physical currency makes it easier to stick to a budget. When you pay with a credit card, it’s easy to overspend without realizing it.

- Watch over your credit card balances like a hawk. Be mindful and aware of your debt. Having laser focus and being watchful is not about being stressed but rather, it’s about taking responsibility. Pay your credit card due in full each month. Avoid paying the minimum payment, as this causes interest charges to accumulate. If you can’t pay in full, pay as much as possible above the minimum.

- Be wary of opening many credits. Have just 1 or 2 and if you need more, you must take a close look at your financial status and habits. The more cards you have, the easier it becomes to rack up debt across multiple accounts.

- Request a lower credit limit if you’re prone to overspending. Don’t give yourself access to credit you can’t reasonably pay back.

- Make your credit card hard to find. Having a physical barrier can help curb impulse spending.

- Monitor your credit card statements regularly and watch out for unauthorized charges. This helps detect potential fraud and ensures you don’t miss payments.

- Don’t look at credit cards as an easy payment method.

- Monitor your subscriptions and remove the ones you don’t use regularly. Being mindful of your financial activities and transactions is key to moving forward and being successful in personal finance.

Track Your Spending Habits

A basic practice in personal finance is tracking your expenses and spending habits. Let’s explore specific ways your mindset about money is linked to your spending.

- As mentioned in the previous section, tracking your credit card and expenses in general is important. When you track what you spend, you develop a mindset of accountability and confidence around money since you know what’s happening.

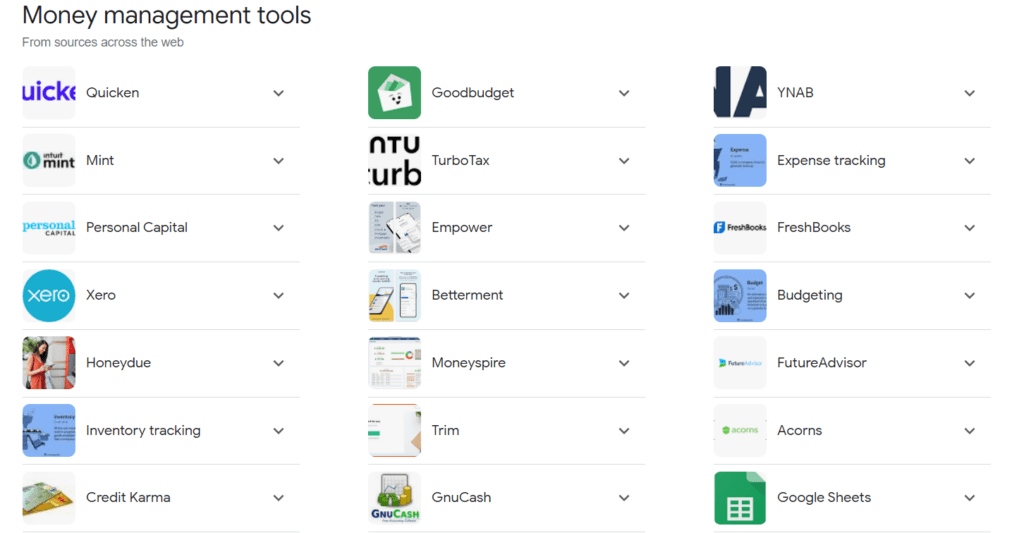

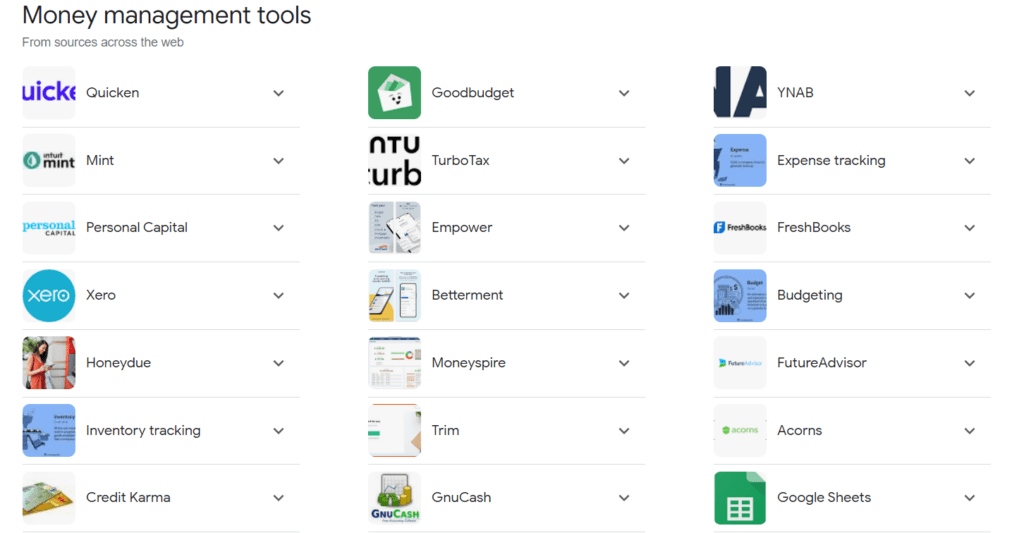

- Get smart and make savings easy. Use budgeting apps and money management tools to make monitoring expenses easier. Categorize spending and create notifications when you go over budget.

- Be diligent about checking each transaction to identify spending triggers. For example, you might notice you frequently spend money on takeout when you’re feeling too tired to cook. Finding patterns like this can help you make beneficial changes to your habits.

Make Learning About Money a Lifestyle

The ability to control and manage money is learned. You don’t have to be a genius to be successful and boost your financial health.

Rather, you need to build a positive money mindset actively and learn about the market, financial instruments, savings, and more actively. Here are more mindset tips to develop:

- Have a learning and growth mindset towards money and its management. You don’t need a genius money mindset to grow your finances.

- You are the average of the five people you spend the most time with. Hang around with other people and communities where they positively talk about money and focus on career growth, investing, and other important financial matters.

- Promote or talk about money in your family and make it a topic everyone is comfortable with. Start by being comfortable with it yourself.

- Subscribe to newsletters and magazines to keep yourself updated. Also, follow relevant finance thought leaders online to fill your social media feed with useful financial tips.

By making finance and money a part of your everyday life, you’ll be more informed and have a healthy money mindset.

Special Money Mindset Tips for Women

I believe that women have different challenges around money. A bad money mindset is often the result of social and cultural conditioning, especially geared toward women. The following tips are from my own experience and teachings by successful women.

- Women are often raised to believe that they should leave their financial affairs to the men in their lives. They lose all sense of control and develop a fear of finances. It is vital for women to realize that they have a right and responsibility to be in charge of their own finances.

- Women tend to think of other people when negotiating for higher pay. There’s an unconscious feeling that asking for more money means taking more from a fixed budget. Women see money as a finite pie and the more they want, the less others get. This isn’t true and should be unlearned. Read Women Don’t Ask by Linda Babcock to learn more.

- According to Linda Babcock’s work, women assume that they’ll automatically be recognized and promoted if they work hard and do more. However, this is not the case. Women need to speak up and ask or say that they expect to get higher pay, be promoted, or get other benefits. Or their labor will be taken for granted and assumed the new normal.

- Stop doing free labor. Doing extra work in the hopes of being recognized does not work. Instead, push for a higher role and pay and then do more. This isn’t so cut and dry in your situation, but keep these points in mind at work.

- Some financial experts believe that women should explore their creativity and lean into starting their own businesses, offering consulting services, and making more money without getting into the masculine drive for hustling.

I strongly recommend that women join communities dedicated to women and money. Being part of a community will create support and encourage you to take charge of your finances. And a community can help women better face the struggles unique to them.

Reclaim Your Financial Life and Develop a Positive Money Mindset

To sum it up, changing your money mindset can have a huge impact on your financial well-being and future success. The right money mindset won’t happen overnight, but by putting some of the tips that we’ve discussed above into practice, you can steadily shift your behaviors.

Even small, positive changes to your thoughts, habits, and attitudes about money can add up to big results over time. Creating good money habits now will have a positive effect on your financial situation for years to come.

Don’t let your past experiences or current circumstances determine your future – you have the power to take control of your financial life. Why not make today the day to start moving in a more positive direction?